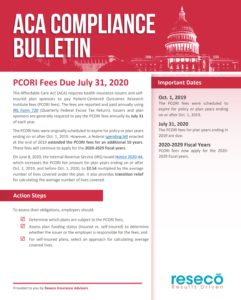

The Affordable Care Act (ACA) requires health insurance issuers and selfinsured plan sponsors to pay Patient-Centered Outcomes Research Institute fees (PCORI fees).

The fees are reported and paid annually using IRS Form 720 (Quarterly Federal Excise Tax Return). Issuers and plan sponsors are generally required to pay the PCORI fees annually by July 31 of each year.

The PCORI fees were originally scheduled to expire for policy or plan years ending on or after Oct. 1, 2019. However, a federal spending bill enacted at the end of 2019 extended the PCORI fees for an additional 10 years. These fees will continue to apply for the 2020-2029 fiscal years.

On June 8, 2020, the Internal Revenue Service (IRS) issued Notice 2020-44, which increases the PCORI fee amount for plan years ending on or after Oct. 1, 2019, and before Oct. 1, 2020, to $2.54 multiplied by the average number of lives covered under the plan. It also provides transition relief for calculating the average number of lives covered.

Action Steps

To assess their obligations, employers should:

- Determine which plans are subject to the PCORI fees;

- Assess plan funding status (insured vs. self-insured) to determine whether the issuer or the employer is responsible for the fees; and

- For self-insured plans, select an approach for calculating average covered lives.

Important Dates

Oct. 1, 2019

The PCORI fees were scheduled to expire for policy or plan years ending on or after Oct. 1, 2019.

July 31, 2020

The PCORI fees for plan years ending in 2019 are due.

2020-2029 Fiscal Years

PCORI fees now apply for the 2020-2029 fiscal years.

This Compliance Bulletin is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice. ©2020 Zywave, Inc. All rights reserved.

For More: